Lake Forest Park council sends police levy to voters

In a 4-to-3 vote, the Lake Forest Park city council approved a ballot measure asking voters to fund police and public safety services

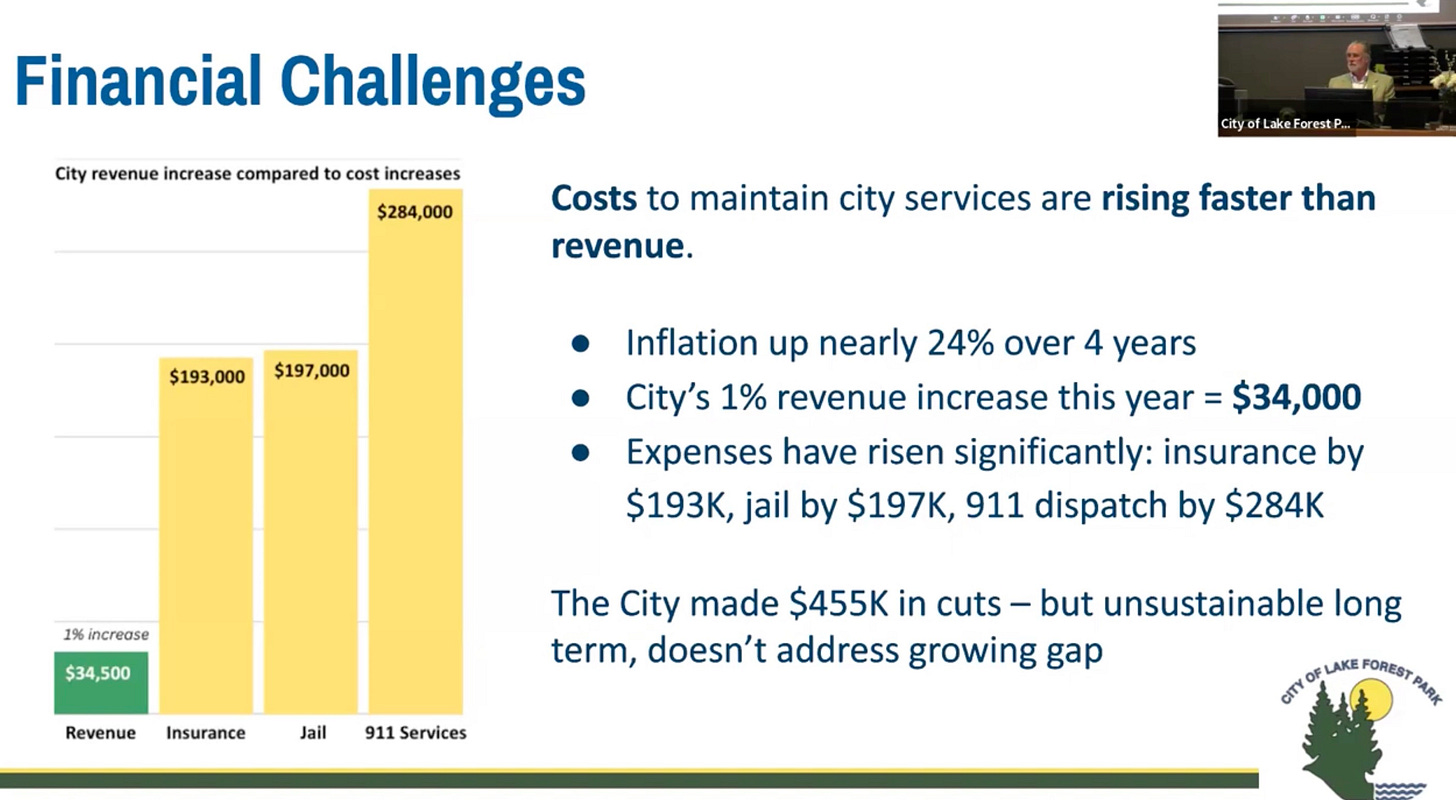

The city says it has already cut nearly half a million dollars in expenses from the budget. But they are still facing almost a million-dollar deficit per year. That’s because police and public safety costs have increased 24%, but the state only allows the city to raise property taxes by 1% each year. Opponents say the financial situation isn’t that bad, and there are other options. Similar to other Sheriff contract cities, neighboring Shoreline and Kenmore spend 40% less per-capita on police than LFP.

If approved by voters in the November election, the “levy lid lift” would bring in an additional $1.2 million in revenue each year for six years to fund police, 911 dispatch, jail, prosecution, defense, crisis co-responders, and other public safety costs. A typical median-valued LFP homeowner would pay about $220 more per year in property taxes.

In a social media post from the city, LFP Police Chief Mike Harden said, “Right now our department is stretched thin. We're working hard to fill positions, but it's tough. The applicant pool is small, and pay competition is high. If staffing gets cut, response times will slip, and we won't have the coverage our community needs.”

With competition for police officers fierce, salaries have increased. A Collective Bargaining Agreement with the Lake Forest Park Police Guild recently negotiated an over 20% increase in salaries and benefits over the next 3 years.

Police 911 dispatch costs have increased by $284,000 (about 78%) after the city of Bothell ended its contract with LFP. “We had a very, very, very good deal. They were undercharging us. Ostensibly there really is only one other player in this game, and that's who we're working with [now],” said Mayor Tom French. The city recently signed a contract with NORCOM for 911 police dispatch. Neighboring Shoreline and Kenmore receive 911 dispatch services as part of their contracts with the King County Sheriff’s Office.

The amount it costs the city to jail prisoners has more than doubled by $197,000, and insurance costs have increased by $193,000. LFP public defender costs are expected to triple over the next 10 years due to new rules from the State Supreme Court regarding public defender caseloads, and prosecutor costs have also increased.

In his April State of the City Address, Mayor Tom French spoke about the value of the LFP police department and municipal court. “The city provides a variety of things, and many residents don’t recognize them. First of all, we have our own police and our own courts. We deeply value the services that both our public safety services and our judicial system provide. Many cities, and most cities of our size, do not have those kinds of opportunities for the community to be represented locally in law enforcement and the courts,” he said.

Unlike neighboring Shoreline and Kenmore, who have contracts with King County District Court, LFP operates its own municipal court. The cities of Shoreline, Kenmore, Redmond, and Auburn (and recently Bellevue) all partner with King County District Court to provide Community Court, an alternative to traditional court for nonviolent misdemeanor cases. Community Courts reduce costs on conventional court systems by diverting individuals from jail and instead connect participants with services. Lake Forest Park does not provide Community Court services.

Approximately $122,269 in funding for the Regional Crisis Response (RCR) is also at stake. A partnership between the North King County cities of Shoreline, Lake Forest Park, Kenmore, Bothell, and Kirkland, RCR deploys social workers alongside police officers to de-escalate behavioral health crises and connect people to services. In 2024, RCR reported 59 encounters in Lake Forest Park, with 44 of those responding to a 911 police call.

RCR saves officer time and helps to avoid use of force by diverting cases more appropriately suited for mental health professionals according to LFP Police Chief Mike Harden. “So as for whether RCR saves officers time for handling crime-related calls on the surface, absolutely. When RCR takes over, assists, or follows up on a case, that's time an officer would have otherwise spent on the incident. That said, it's challenging to quantify precisely how much time is saved, since we can't measure what would have happened in RCR’s absence. So still anecdotally and operationally, their involvement clearly provides relief to our patrol workloads,” he said.

Deputy Mayor Tracy Furutani has been a vocal supporter of taking the levy to voters. “These are not nice to haves, these are we gotta haves. Otherwise, we're not really running a city,” said Furutani. Comparing LFP’s situation to neighboring Brier, where a levy failed recently, he said, “the voters in Brier did turn down the levy increase there, but they're in dire straits. As a result, I don't know what they're going to do about their public safety, because they literally cannot cover the costs.” The Snohomish County Sheriff’s Office has provided police coverage to Brier amidst staffing shortages.

It’s been 25 years since LFP voters approved a property tax increase. A 2010 levy failed with 78% of voters opposing, and a 2021 levy to pay for parks and sidewalks also failed with 65% of voters against it. The Edmonds City Council recently voted to place a $14.5 million levy to pay for police, parks, planning, streets, and sidewalks on the November ballot. Woodway voters approved a public safety levy last year. But, in addition to neighboring Brier, voters in Des Moines and Monroe rejected police levies recently.

Councilmember Jon Lebo has been a vocal critic of the levy. “The property tax is a regressive tax. It's not income-based. […] Renters don't have the advantage of, for example, being able to get a low income or senior discount because the property tax is part of the rent. […] We do have other levers of raising revenue. Administrator Hill did say that there is the opportunity for a sales tax: a one-tenth of one percent increase,” he said speaking in support of using a new sales tax for police recently approved by the state legislature.

Lebo argued that the city’s financial situation is not as dire as presented. “We are not cutting services for 2026, and I would be opposed to cutting services in 2027. […] I am comfortable with a lower fund balance than we currently have. I think we've been fortunate over the last few years to have a significant increase in the fund balance. It's difficult for me to say to the citizens: We need more of your hard-earned money because we don't think that we can run our city on a less of a fund balance than we have now of about 10 million dollars. […] I think the citizens have been pretty clear. They do want the city to run lean,” he said.

Lebo stated his preferred approach, "I think I've been pretty clear about my position about this levy, which I think is premature, and that I've asked for in the past and suggested that we have a Citizen Financial Sustainability Committee to have the citizens involved in deciding […] how we manage the budget going forward." Lebo would have supported a lower levy rate, "I think we're going a little too far. I would be supportive of a levy rate of 12 cents. So with this particular resolution, I will not be supporting that,” he added.

Public safety is the largest, single expense in the Lake Forest Park budget, accounting for over a third of budgeted expenses. LFP plans to spend about $6 million on police services in 2025 with a population of 13,700; on a per-capita basis, LFP residents pay about $438 per year for police services. In contrast, Shoreline residents pay about $296 per year, and Kenmore residents pay around $216. That’s typical. Cities in King County with Sheriff contracts pay about 40% less per capita for police services on average than cities like Lake Forest Park that operate their own police departments.

The levy lid lift will be temporary and last for six-years from 2026 through 2031. After lengthy debate, the council ultimately settled on asking voters for an increase of $0.24 per $1,000 of assessed valuation in 2026. This would roughly mean that a typical homeowner could see an increase of about $219.36 per year. Currently, a typical, median-valued LFP home is assessed around $914,000 and pays King County a total property tax bill around $8,000 to $9,000 per year. The city of Lake Forest Park receives only a fraction of that total paid to the county, about $0.71 per $1,000 of assessed value: somewhere around $600 or $700 for a typical, median-valued LFP home.

Property owners can look up the assessed value of their home at the King County Assessor’s website. Under state law, qualifying low-income seniors, disabled veterans, and other persons with disabilities would be exempt from any levy increases.

In a split vote with 4 in favor to 3 against, the Lake Forest Park City Council approved the resolution to send the levy to voters at the July 10 meeting. Deputy Mayor Furutani, Vice Chair Goldman, Councilmember Saunders, and Councilmember Riddle voted in favor, and Councilmember Lebo, Councilmember Goode, and Councilmember McCartney opposed.

The levy lid lift measure will appear on the November 5, 2025 ballot. The city is seeking residents to serve on “pro” and “con” committees to write official statements for and against the measure. Interested residents need to email the City Clerk by 5:00 p.m. on Thursday, July 17 and can learn more at the city’s website.

A $200/year increase on top of my existing $8400 annual property tax doesn't sound like much, but how much will other taxing districts also increase their share of my annual bill? When voters understand that LFP's proposed 0.24 levy is added to our existing 0.71 rate they will recognize it as a 34% tax increase. Unlike our sales tax or our gas tax or our utilities tax where we just get nickeled and dimed throughout the year, our property tax causes me to actually write a big check every six months and it really gets my attention. With those other taxes we can try to buy less or drive less or be more careful with our utilities. But our house assessed value is unrelated to how much we earn or how much we spend every day. I agree with Councilman Lebo that tapping taxpayers for an additional $1.2million when our city's cash balances are running around $10million is the wrong idea at this time.